Key takeaways Chapter 7 and Chapter 13 bankruptcy are common options for individuals with unmanageable debt. Bankruptcy may be the right choice if you’re facing overwhelming debt, frequent creditor calls or risk of foreclosure. It’s important to weigh the pros and cons: Filing for bankruptcy can hurt your credit score…

Key takeaways Making savings goals is one way to keep your spending in check. Being specific and setting realistic expectations can guide you in the right direction. Automating your savings can help you meet your goals with no extra work required on your part. One of the basics of building…

Employers offer many forms of compensation besides cash, with employee stock options being a popular choice. Instead of issuing shares directly, employee stock options allow workers to purchase shares of their company at a given price within a certain time frame. While this can be a valuable benefit for employees,…

Buying an annuity is a major financial decision. You’re often tying up your money for a long time and, since many people use these financial products to fund their retirement, you’ll be relying on those payments for years to come, sometimes the rest of your life. Before you make a…

Personal Finance

A perfect storm is brewing for millions of federal student loan borrowers, who may experience dramatic increases in their monthly…

As the Biden administration exits Washington, President-elect Donald Trump inherits a federal student loan system that looks much different than…

Republican lawmakers in Congress are circulating a number of proposals to cut federal spending as part of a massive bill…

Wildfires in southern California have burned at least 47,000 acres in the Los Angeles area—the largest blaze, the Palisades Fire,…

Featured Articles

Have you ever had a free trial that turned into a paid subscription without your knowledge? Or had trouble canceling a service you no longer wanted? As the subscription economy continues to grow, it’s an increasingly common problem. Have a question about credit cards? E-mail…

Dept Managmnt

Key takeaways A balance transfer fee is what credit card issuers charge when you transfer debt, usually credit card debt, to another credit…

Banking

No matter how often bank regulators, international standard setters, rating agencies, or financial reform advocates warn banks that climate change is serious, the…

Credit Cards

Key takeaways The Southwest Companion Pass is attainable by using Southwest credit card welcome bonuses to meet the 135,000-point requirement. Applying for a…

All News

A dividend stock is a publicly traded company that regularly shares profits with shareholders through dividends. These companies tend to be both consistently profitable and committed to paying dividends for the foreseeable future. While perhaps less exciting than chasing the latest high-flyer in the stock market, dividends can account for…

Halfpoint Images/Getty Images Many people strive to achieve $1 million in savings before they reach retirement, but the reality is that most Americans struggle to meet that savings threshold. Average retirement account balances for those aged 55-64 averaged about $208,000 at the end of 2022 in plans administered by Vanguard,…

Warren Buffett is among the greatest investors of all time. His company, Berkshire Hathaway, has returned around 20 percent annually since Buffett took over in the 1960s, trouncing the S&P 500’s annual return over that time period. In 2024, Buffett has sold shares in some longtime holdings, such as Apple…

Key takeaways Most residential homebuyers and sellers work with a real estate agent who represents them in the transaction. Some agents specialize in representing either buyers or sellers, and dual agents may represent both parties in the same transaction. Real estate agents are typically compensated on a commission basis,…

Key takeaways There are many ways to get free financial advice from a variety of sources. It may be possible to see a financial advisor for free or at a reduced cost. When dealing with more complex financial planning issues, such as estate planning or starting a business, it may…

Career woman. The kids’ taxi driver. Master of the budget. Grocery shopper, chef, and cleaner-upper. Single moms carry these titles and more day in and day out. Talk about busy schedules filled with meaningful responsibilities! Over the years, we’ve had a countless number of single moms call and write in…

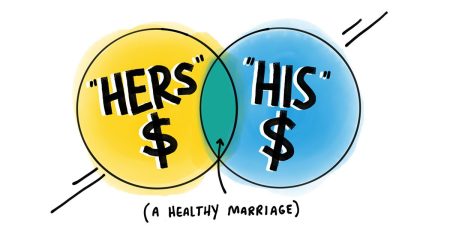

Marriage and debt are like pregnancy and . . . nausea. For most people, you can’t have the exciting part without the latter. In fact, 63% of marriages start out in debt.1 Take Grace’s story, for example. She was completely debt-free with $10,000 in the bank before she got married.…

You’ve watched so many episodes of Fixer Upper you can practically guess what new home remodel miracle Chip and Joanna Gaines are about to pull off. And sure, their projects look hard, but you’re up for the challenge. Now you’re thinking of buying a fixer-upper yourself. Whether you’re a first-time…

One of the questions I’m asked most often is, “How can I talk to my spouse about money?” If you’re looking for that answer, I’m so glad you’re here. Talking about money can be intimidating for any number of reasons. Maybe one of you is reluctant to tackle your money…

Do you think combining money and marriage is a recipe for disaster? You’re not alone. Money is the number one issue married couples fight about, and it’s the second leading cause of divorce, behind infidelity.1 When we talk about money in relationships of any kind, we’re bound to find some frustration…