Key takeaways Hilton Honors is the hotel loyalty program associated with the Hilton brand. Hilton Honors members can earn and redeem points at more than 8,000 properties around the world. There are many ways to earn Hilton Honors points, including paid hotel stays, spending with co-branded Hilton credit cards, travel…

Key takeaways In most cases, digital wallet purchases deliver the same rewards as physical card transactions. Some cards even offer enhanced rewards for digital purchases, as in the case of Apple Pay credit card rewards with the Apple Card. Read your cards’ fine print and to check with each issuer’s…

After four thousand years of bad experiences, you’d think politicians and others would have learned the folly of price controls. Such restrictions lead to shortages, black markets and other destructive consequences. They didn’t save the Roman Empire, and they helped destroy the presidency of Richard Nixon. But like mosquitoes and…

*Citi is an advertising partner. Key takeaways Citi Entertainment is available for all Citi credit and debit cardholders and offers exclusive access to events, presale tickets and VIP packages. The best way to maximize Citi Entertainment is to have an eligible Citi card and to understand the program’s features and…

Personal Finance

Technology has transformed some parts of the daunting homebuying process–making it easier to search and compare properties online, to prepare…

The Covid pandemic crushed immigration and demand for Nova Credit’s tech. Then its founder discovered a second line of business.…

A perfect storm is brewing for millions of federal student loan borrowers, who may experience dramatic increases in their monthly…

As the Biden administration exits Washington, President-elect Donald Trump inherits a federal student loan system that looks much different than…

Featured Articles

OsakaWayne Studios/Getty Images Gold is an asset that’s often viewed as a safe haven by investors when times get tough. It has a long track record as a store of value, which gives some investors comfort when the rest of the investment landscape feels uncertain. …

Dept Managmnt

Debt settlement is when you negotiate with creditors to reduce the amount you owe in exchange for a lump sum payment. It might…

Banking

F or private financial technology companies, last year was a quiet one for fundraising. Fintechs raised $34 billion in 2024, down from $42…

Credit Cards

Key takeaways The Southwest Companion Pass is attainable by using Southwest credit card welcome bonuses to meet the 135,000-point requirement. Applying for a…

All News

FG Trade Latin/Getty Images Key takeaways M&T Bank offers a variety of auto loans that could be a good fit for you if you’re a non-military member. A USAA auto loan may be best for military members and qualifying family members seeking a lender with competitive rates. If you’re a…

Key takeaways Working capital loans are a type of short-term business loan that can help businesses cover immediate costs like payroll, inventory or rent Working capital loans offer fast funding and can have relaxed eligibility requirements, but they have small loan amounts and short repayment terms with frequent payments Interest…

Key takeaways Upstart may be better for borrowers with poor credit looking to refinance their auto loans since it has a low minimum credit score requirement. By comparison, Caribou may be a better choice if you need to refinance a high loan amount — the maximum amount you can refinance…

Average annual yield refers to the average return (or profit) earned by an investment over the course of a year. You’ll most likely see the number depicted as a percentage. The average annual yield can be calculated for investments like stocks, bonds, mutual funds and savings accounts, and it can…

Key takeaways Carputty is a strong fit for a borrower with good credit who intends to switch up their car on a frequent basis. Autopay is best for those who want to get cash through a vehicle’s equity. When comparing auto loan options, look out for special features, available rates…

Key takeaways Fast business loans are convenient, but they may come with high rates and fees and may not offer the best repayment terms or loan limits Before signing a fast business loan agreement, be sure to review all your options, including any alternatives Alternatives to fast business loans include…

Many of us have had the experience of using credit cards when we should not or putting one more thing on the card and hoping we will be able to pay it off at the end of the month, but then…something else comes up. Credit card balances can grow quickly…

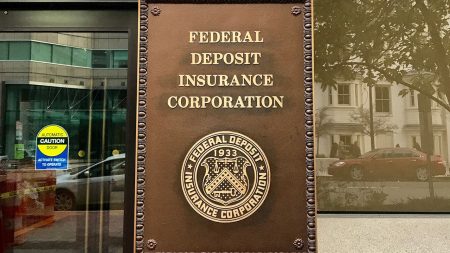

Key takeaways FDIC insurance is backed by the full faith and credit of the U.S. government and guarantees bank consumers that their money is safe for up to a limit of $250,000 per depositor, per FDIC-insured bank, per ownership category. FDIC insurance covers traditional bank deposit products from insured banks,…

3 Changes Boomers Should Make To Their Retirement Strategies Now That Trump Is President Again

Baby boomers and others nearing retirement should pay careful attention to their investments, especially now that newly elected President Donald Trump is shaking up the economy. Regardless of whether you like Trump’s economic policies, you need to be carefully preparing for retirement. “The actions of this new administration calls on…

Credit Sesame discusses the relationship between debt consolidation and credit scores. Consolidating debt can simplify payments, but it’s important to understand its impact on your credit score. Recent news has shown that Americans’ debt struggles are growing. Debt balances are rising, and more and more households are falling behind. Much…

Editor's Pick