Credit Sesame looks at the looming credit score bump reversal and what it could mean for student loan borrowers. The government did more than pause student loan payments during the pandemic. It also effectively gave many student loan borrowers a bump in their credit scores. Now comes the bad news.…

A talented hacker might be able to easily crack the password for your bank account – especially if it falls under the easy-to-guess formula of your first name and last initial. However, if you have two-factor authentication enabled, it’s going to be a lot tougher for them to actually log…

Key Takeaways Bank account fraud comes in many forms including check fraud, P2P payment scams, ATM skimming, phishing and wire transfer schemes. Prevention is your first line of defense. Use tools like account alerts, cardless ATM access, strong passwords and secure Wi-Fi. If you fall victim to a scam, act…

Key takeaways Adding authorized users to your business credit card account can make it easier for your business to complete purchases, earn rewards and improve bookkeeping. You can often set individual spending limits for your employee cards, which helps protect you from rogue spending. It’s usually simple to…

Personal Finance

While there has been much conversation on not buying from companies with poor diversity, little has been said about investing…

Lifestyle inflation occurs when your expenses increase as you earn more income. It can start subtly—dining at pricier restaurants, upgrading…

Chime, the largest digital bank in America, grew its revenue to $1.7 billion in 2024, an increase of roughly 30%…

Technology has transformed some parts of the daunting homebuying process–making it easier to search and compare properties online, to prepare…

Featured Articles

Images by GettyImages; Illustration by Hunter Newton/Bankrate The best bank and credit union for you will depend on your banking needs, but in general, the best banks offer accounts with low or no minimum balance requirements and don’t charge monthly fees — or at least…

Dept Managmnt

By Garrett Johnson For Canadians, tariffs on American goods could mean higher prices for the average consumer. With over 70% of Canada’s trade…

Banking

Apple, FedEx and Oracle all got loans guaranteed by the Small Business Administration. But rules and red tape keep many banks from making…

Credit Cards

All News

Key takeaways Unlike banks, many credit unions often limit membership to eligible individuals on the basis of belonging to the same community, workplace or organization (though there are credit unions with unrestricted membership rules). Credit unions tend to offer lower fees compared to banks, but you should still compare fees…

Tether (USDT) is a stablecoin, which is a type of cryptocurrency designed to maintain a steady value over time. It’s different from other crypto coins, like Bitcoin or Ethereum, because its price is pegged to the U.S. dollar. Here’s what you need to know about Tether and how it works. …

A 401(k) retirement plan is one of the most popular ways to save money for retirement and score some tax breaks for doing so. But often these plans don’t provide a lot of guidance on how to manage them, and participants end up with wildly aggressive portfolios, or, what experts…

Tesla (TSLA) has been making a lot of news recently — and for all the wrong reasons. The stock is down more than 50 percent from its all-time high three months ago, and while the skid has leveled off recently, it’s by no means certain that the bottom is in.…

kate_sept2004/ Getty Images; Illustration by Austin Courregé/Bankrate Key takeaways SBA 7(a) loan rates range from 10.50 percent to 15.50 percent, depending on whether it’s a fixed or variable rate loan The SBA limits interest rates to keep loans accessible to financially disadvantaged businesses Loans over $1 million also come with…

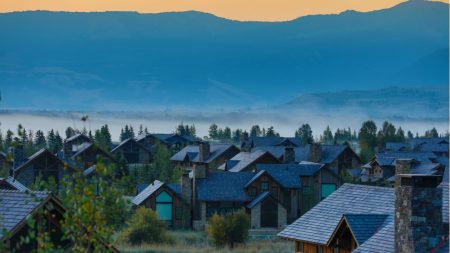

Nicole Glass Photography/Shutterstock Buying your first home is a huge financial undertaking, and the down payment and closing costs can be major hurdles. The good news? If you’re on the hunt for a home in Wyoming, the Wyoming Community Development Authority can connect you with an affordable mortgage and down…

Key takeaways Increasing a home’s curb appeal can garner more offers and potentially even a higher price for sellers. Some projects are pricey, but even inexpensive updates like fresh paint on the front door can make a difference. Don’t go overboard — focus on just the projects that will have…

Daniel Zuchnik/Getty Images The stock market has had a bumpy start to 2025, with major indexes such as the S&P 500 and Nasdaq Composite falling into correction territory and several recent market darlings seeing major declines. But legendary investor Warren Buffett and his vast conglomerate Berkshire Hathaway (BRK-A) (BRK-B) haven’t…

Key takeaways The Wells Fargo Reflect® Card carries no annual fee and has one of the longest introductory APR offers on the market. There are no rewards programs or ongoing perks outside of cellphone protection, Visa travel benefits and Wells Fargo deals on the card. This card is one of…

When you take out a loan from your 401(k) plan, you’ll get terms like you would with any other type of loan: There’s a repayment plan based on how much you borrow and the interest rate you lock in. According to IRS rules, you have five years to pay back…

Editor's Pick