Hey, have you heard? Navient is canceling a bunch of student loans! But don’t blast that celebration playlist just yet. Not everyone gets a piece of this pie.

If you’re wondering, Will Navient cancel my student loans? keep reading. We’re breaking down exactly what’s happening with the latest Navient student loan situation—and what that means for you.

What’s Going on With Navient Student Loans?

On January 13 of this year, Navient (one of the biggest student loan companies in America) announced they agreed to a $1.85 billion settlement with more than 35 states.1,2 A settlement for what exactly? Long story short, a group of attorneys general from multiple states sued Navient for predatory student loan practices (aka for doing some real shady stuff to put students in debt and keep them in debt).3

The lawsuit claimed that Navient pushed borrowers to apply for student loan forbearance, which let them postpone payments but still charged them interest. Navient was also accused of convincing students to take out subprime private loans (loans with super-high interest for people with bad credit), even though Navient (which was Sallie Mae at the time) knew those students were unlikely to be able to make their loan payments later. These loans were mostly offered to students who were attending for-profit colleges (like ITT Technical Institutes and the Art Institutes) that have lower graduation rates.4

Yeah, it’s all as scummy as it sounds. Sallie Mae/Navient was basically setting students up to fail and burying them even deeper in debt.

“Navient repeatedly and deliberately put profits ahead of its borrowers—it engaged in deceptive and abusive practices, targeted students who it knew would struggle to pay loans back, and placed an unfair burden on people trying to improve their lives through education,” said Pennsylvania Attorney General Josh Shapiro, one of the people who championed the lawsuit.5

Navient won’t admit they broke any laws, but they agreed to a settlement to avoid dragging the issue out in court any longer (so they say).6 As part of the settlement, Navient will be canceling $1.7 billion in private student loans and paying $95 million in restitution to borrowers who were victim to their predatory tactics, plus another $145 million to the states involved.7 It seems that what goes around comes around, Navient.

You may also remember that in the fall of 2021, Navient tapped out of the federal student loan game, passing on their 5.6 million federal student loans to a new company—Aidvantage.8 It could be that Navient was trying to wash their hands of some of the mess while they still could. But they’re definitely having to pay for their crooked actions now.

Whose Student Loans Will Be Forgiven?

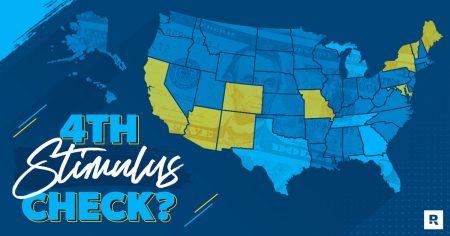

While it’s good news that Navient is being forced to cancel some student loans, don’t get your hopes up just yet. Only about 66,000 borrowers are actually going to reap the benefits of the Navient settlement—specifically, those who took out private student loans through Sallie Mae from 2002 to 2010 to attend certain for-profit schools.9 (In 2014, Navient took on most of Sallie Mae’s student loans, which means they’re now legally liable for what happened.) The borrowers also must have defaulted on these loans before June 30, 2021, and live in one of the 38 states (plus Washington, D.C.) that are part of the lawsuit.10

|

Here are the states that are part of the Navient student loan settlement:11 |

|

|

Arizona |

Arkansas |

|

California |

Colorado |

|

Connecticut |

Delaware |

|

Florida |

Georgia |

|

Hawaii |

Illinois |

|

Indiana |

Iowa |

|

Kansas |

Kentucky |

|

Louisiana |

Maine |

|

Maryland |

Massachusetts |

|

Michigan |

Minnesota |

|

Missouri |

Nebraska |

|

Nevada |

New Jersey |

|

New Mexico |

New York |

|

North Carolina |

Ohio |

|

Oregon |

Pennsylvania |

|

Rhode Island |

South Carolina |

|

Tennessee |

Vermont |

|

Virginia |

Washington |

|

West Virginia |

Wisconsin |

|

The District of Columbia |

|

Yep, that’s a lot of very specific hoops you have to jump through to qualify. But if you are indeed one of the 66,000, you should be getting a notice from Navient verifying your student loans are canceled by July of this year.12

Pay off debt fast and save more money with Financial Peace University.

But wait—those of you who have federal student loans may still be able to get something out of this deal. Navient is also having to pay $95 million in restitution to borrowers who placed their federal student loans in long-term forbearance because a Navient agent told them to. If you spread $95 million over an estimated 350,000 affected borrowers, you’re looking at around $260 for each person.13 Not a lot, but it’s something!

Again, you’ll be told if you get anything. So make sure your contact information is up to date for both Navient and your studentaid.gov accounts. But whatever you do, don’t bank on this deal until you get it in writing!

How Does This Impact the Student Loan Industry?

Listen, $1.7 billion is a lot of money. But that’s less than 1% of the nearly $1.6 trillion of national student loan debt!14 The truth is, the amount of debts Navient was forced to cancel is only a tiny slice of the money student loan companies have managed to steal from borrowers over the last several decades. (Watch the Borrowed Future documentary and see for yourself just how toxic and out of control the student loan crisis really is.)

Still, the Navient student loan settlement is a huge win—not just for the borrowers involved, but for anyone who has student loans. The fact that politicians from both parties banded together against a student loan company proves just how big of a problem this is for Americans. The Navient settlement sets a solid example for possible future lawsuits against other private student loan companies.

But Navient is still in business, which means they’re still able to lure the next generation into taking out loans. And they aren’t the only lender out there toeing the legal line. We’ve got a long way to go before the student loan industry no longer has the power to trap kids in a cycle of crippling debt.

What Does This Mean for Your Student Loans?

So, what if you aren’t one of the chosen 66,000 to have your student loans canceled by Navient? Sorry, but nothing’s changed for you. As of right now, collections for federal student loans are still on hold until January 2023 (thanks to the CARES Act), and President Biden’s forgiveness plan only affects those with federal student loan debt.

But private student loans are a whole other beast. Sallie Mae, College Ave, SoFi—they’re still going to expect that monthly payment from you on time.

If you’ve got student loans, the best thing you can do is keep paying toward them, even if you don’t technically have to right now. The faster you pay off your student loan debt, the sooner you can stop stressing about those payments!

Yes, big settlements like the Navient one give us hope. But that’s a rare case. And if you’re waiting on your lender to get sued or go out of business, you could be waiting a very long time. Never leave your financial future up to chance—unless you want to be majorly disappointed.

Things You Can Do Right Now to Help You Get Rid of Your Student Loans

Forget waiting on the government to come to the rescue. Here are some action steps you (yes, you!) can take to pay off your student loans:

- Get on a budget. You may not be able to control how the government spends its money, but you can definitely control how you spend yours. A budget helps you know exactly where your money is going every month and where you can cut back. When you see it all written out, you’ll be surprised how much extra money you can find to put toward your student loan debt!

- Use the debt snowball method. The best way to pay off your student loan debt is with the debt snowball method. Here’s how it works: You list out your debts from smallest to largest (regardless of interest rate) and make minimum payments on all of them except the smallest one. What do you do with your smallest debt? You attack it! You use whatever extra money you can get by trimming your budget or taking on a side hustle, and you throw it all at your debt. With that kind of intensity and momentum, you’ll be able to crush that smallest debt in no time! Then, take the money you were putting toward that debt and throw it at your next-smallest debt. Repeat the process until you are debt-free!

- Find out how fast you can pay off your student loans. Student loan payment plans are designed to keep you in debt for literal decades. And if we’ve learned anything from this Navient deal, student loan lenders would rather you delay, delay, delay. Because the longer they can keep you in debt, the more money they can collect from you in interest. But that ends now! Use our Student Loan Payoff Calculator to find out exactly how soon you can knock out your student loan debt—and how much you can save on interest!

- Refinance your student loans. Refinancing your student loans is only a good option if it will give you the push you need to pay off your debt faster. By refinancing, you can get a lower fixed interest rate and use the savings to speed up your debt payoff. See if refinancing your private student loans is right for you.

- Get our student loan guide. Feeling overwhelmed by your loans and not sure where to start? Check out our Guide to Getting Rid of Your Student Loans. It breaks down everything you need to know about student loan forgiveness, relief options, paying off your debt and more. Get the tools and resources you need to make progress on your student loans faster!

Okay, so now you have a plan! No more letting companies like Navient steal from you. It’s time to take back control.

Read the full article here