Citi is an advertising partner.

Key takeaways

- The AAdvantage Dining program offers the opportunity to earn airline miles by dining out at participating restaurants instead of traveling with the airline.

- By dining out and meeting certain requirements, you can progress through different tiers of the program, including becoming a VIP member.

- Miles earned through the American Airlines AAdvantage Dining program can be redeemed for a variety of travel-related expenses, including flights and hotels.

If you’re not flying at the moment but want to rack up miles for your next trip, there are numerous options to consider. For example, you can apply for an airline credit card to earn a big sign-up bonus and miles for every dollar you spend. You can also take advantage of travel shopping portals, which let you earn miles simply by signing up and “clicking through” before you shop at participating stores.

Airline dining programs offer yet another way to rack up miles, without any additional work or major hoops to jump through. After all, you may already be dining at restaurants that participate in these programs, but you’ll never know unless you check.

American Airlines’ AAdvantage Dining℠ program could include a surprising number of participating restaurants in your area. If you want to rack up more American Airlines AAdvantage miles this year and dine out frequently, here’s what you need to know.

What is American Airlines AAdvantage Dining?

The American AAdvantage Dining program offers a way to earn airline miles without actually flying a single mile. This program includes an array of participating restaurants, letting you earn airline miles whether you’re exploring a new eatery or enjoying a meal at one of your favorite establishments.

Keep in mind that the rewards you earn through the American Airlines AAdvantage Dining program are in addition to any rewards you earn with a rewards credit card. This means that you could earn, for example, 2 points per dollar spent using your preferred rewards card at a restaurant, along with additional airline miles through American Airlines AAdvantage Dining.

If you dine out often, you can ascend through the tiers of this program until you become a VIP.

How to sign up

Signing up for the American AAdvantage Dining program is free and easy. Simply visit the dining program homepage and click the button that says “Join Now.”

From there, you can set up an account by entering your name, email address and frequent flyer number associated with the American AAdvantage program. You must also link at least one credit or debit card you intend to use when dining at participating establishments.

Keep in mind that you don’t have to use a co-branded American Airlines credit card to earn rewards through American Airlines AAdvantage Dining. You can use any credit card of your choice, including a flexible travel credit card or even a cash back credit card. The decision is entirely yours.

AAdvantage Dining program membership tiers and their benefits

By understanding the different membership tiers — Basic, Select and VIP — within the American Airlines AAdvantage Dining Program, you can strategically engage with the program to earn more miles, unlock exclusive benefits and enjoy great dining experiences while accruing rewards for travel with American Airlines.

Basic membership

The Basic Tier is the entry-level membership tier within the American Airlines AAdvantage Dining Program. You can simply sign up for the AAdvantage Dining Program for free to get the Basic tier.

Benefits:

- You can earn 1 mile per $1 spent at participating restaurants.

- You have access to exclusive dining offers and promotions.

- You have the opportunity to earn bonus miles for participating in dining-related activities.

Select membership

The Select Tier is the mid-level membership tier within the American Airlines AAdvantage Dining Program. You can achieve Select tier membership by opting for email notifications and dining at participating restaurants multiple times within a calendar year.

Benefits:

All benefits of the Basic Tier plus:

- You can earn 3 miles per $1 spent at participating restaurants.

- You can also earn additional bonus miles for reaching set dining milestones.

- Access to priority customer support for dining-related inquiries and issues.

VIP membership

The VIP Tier is the highest membership tier within the American Airlines AAdvantage Dining Program, offering elite benefits for frequent diners. You can attain VIP tier membership by consistently dining at participating restaurants and achieving 11 qualifying transactions within a calendar year.

Benefits:

All benefits of the Basic and Select Tiers plus:

- You can earn 5 miles per $1 spent at participating restaurants.

- Access to exclusive VIP dining events and experiences.

- You have exclusive access to a VIP Member Service help line.

- You’ll remain VIP status for the next full calendar year.

How to earn and redeem points

American Airlines AAdvantage Dining has a portal that lets you search for participating restaurants in your area. After creating a free account and linking a credit or debit card, you can begin earning rewards by discovering which restaurants participate near your home or in frequently visited locations. You can also earn by placing an online order for takeout or delivery through AAdvantage Dining. Ensure that you pay using a linked card to earn points.

EXPAND

For in-person dining, American Airlines AAdvantage Dining makes it easy to search by your hometown, the town you’re visiting or a specific restaurant name.

To get started, the program even offers 500 bonus miles when you spend $25 at participating restaurants (including takeout and delivery) within the first 30 days. After that, you can earn up to 5X miles at participating restaurants, depending on your membership level.

Your earned miles will typically post to your AAdvantage account within a few days of the transaction. You can track your points and dining activity on the AAdvantage dining program website or mobile app.

Redeeming miles

You can redeem miles earned through the American Airlines AAdvantage Dining program in various ways, including for flights, hotels and other travel.

To redeem miles, log into your AAdvantage account at AA.com and select the type of travel you want to redeem your miles for: flights, hotels, vacations or cruises. Once you fill out the dates and details of your travel plans, make sure you select “Redeem miles” before submitting your request to see prices.

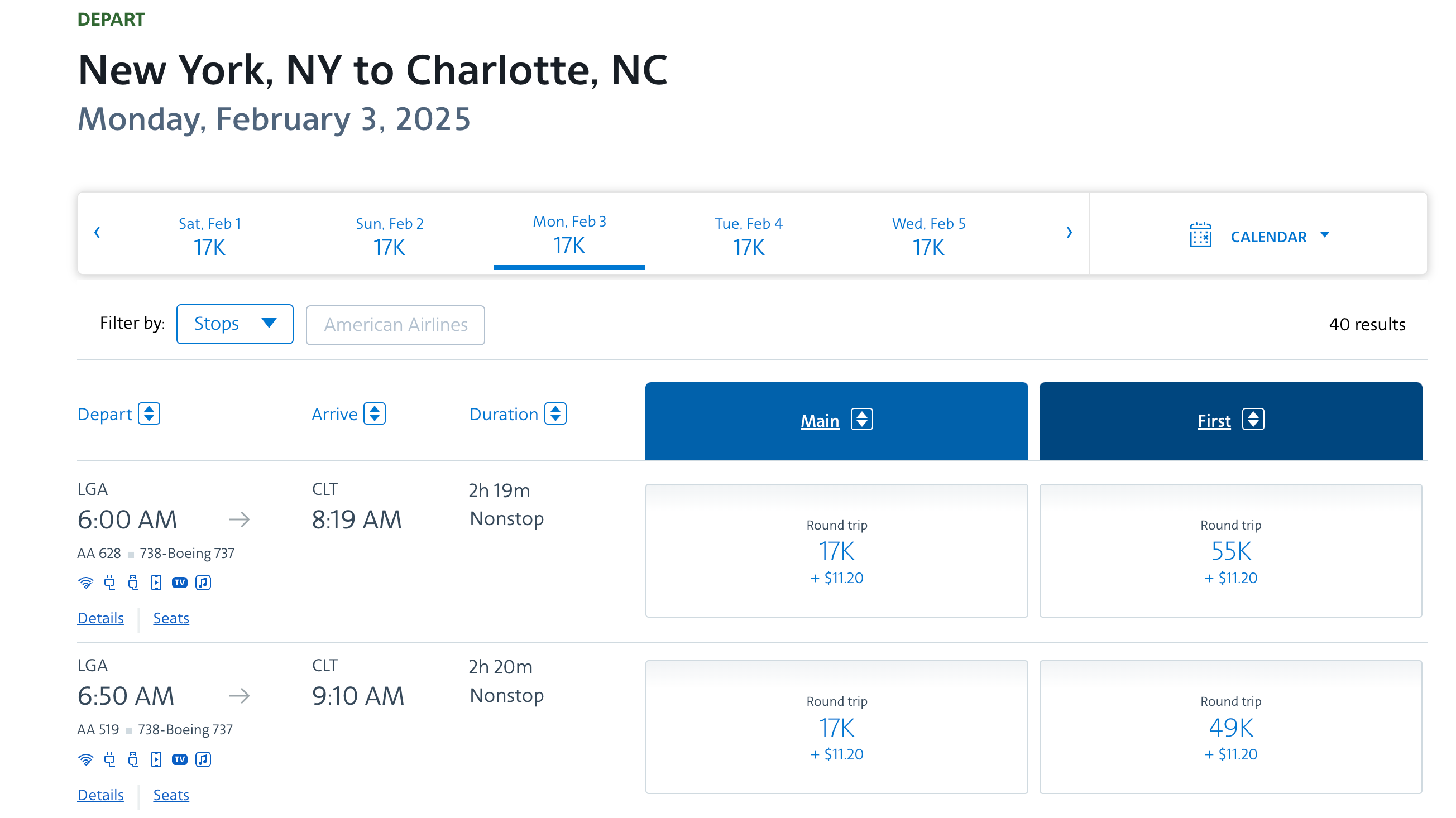

Main Cabin seats in the contiguous 48 states and Canada start at 7,500 miles for one-way airfare, but the amount needed can change based on your travel details. Here’s an example of how many miles you’ll need to fly from New York City to Charlotte, North Carolina in February 2025:

EXPAND

Generally speaking, redeeming your miles for flights is the best way to maximize value. Fortunately, the American AAdvantage program lets you redeem miles for flights to nearly 1,100 destinations around the world, either with American Airlines or its oneworld partners.

Best credit cards for American Airlines AAdvantage dining

You can use any credit card in the American Airlines AAdvantage dining program. However, a co-branded American Airlines credit card can really help you boost your efforts if your goal is racking up miles through the American AAdvantage program.

Here are some of the top credit cards for American Airlines AAdvantage dining, along with key card details.

-

This card’s ability to earn 2X AAdvantage miles at gas stations, restaurants and on qualified American Airlines purchases can help you maximize your mileage earning potential, particularly while eating out, thereby boosting your earnings with the card and in the AAdvantage dining program.

-

Pros

- You can get a free checked bag on American flights, preferred boarding and more, which is ideal for an airline card.

- The annual fee is waived the first year, so you don’t have to worry about that added cost when applying.

Cons

- Even though they have a higher annual fee, there are other AAdvantage cards that offer better benefits and higher rewards rates.

- You have limited flexibility when it comes to redemption, as you can only redeem for American Airlines flights.

-

This card has the potential to increase to 5X miles (per dollar spent) on eligible American Airlines purchases after spending $150,000 in a calendar year. This makes it an attractive option for loyal customers and can significantly boost miles earned if you frequently make purchases with American Airlines.

-

Pros

- You can receive an application fee credit of up to $120 for Global Entry or TSA PreCheck, which is especially useful for frequent travelers who want to save time passing through security.

- You can earn boosted rewards on common travel purchases like car rentals and hotel reservations, which can add up to significant earnings.

Cons

- It has a steep annual fee, which might be feasible for some high-earners or loyal American Airlines customers but a roadblock for those who aren’t.

- If you don’t travel frequently, you might find earning and maximizing rewards challenging, as they are mostly based on high spending requirements.

-

This card is a great choice for solid travel benefits and an attainable welcome offer for a low annual fee if you don’t travel often enough for a higher-tier card but still want to earn rewards on eligible American Airlines purchases.

-

Pros

- You can earn a $99 (plus taxes and fees) annual companion certificate every anniversary year when you spend $20,000 on purchases with your card, which is a unique travel perk not every airline card offers.

- It offers various travel benefits that are typically seen with more robust travel cards, such as in-flight purchase discounts.

Cons

- Some may not find the annual fee worth paying for the low rewards rate.

- You can only earn boosted rewards on qualifying American Airlines purchases, which can make it difficult to maximize your earning if you don’t travel enough.

-

This card is excellent for business owners who frequently travel, as it offers valuable travel benefits and basic rewards for eligible American Airlines purchases as well as common travel and business expenses.

-

Pros

- You can earn decent rewards on typical business spending categories such as telecommunications merchants, cable and satellite providers and more, which is extremely beneficial for most business owners and employees.

- You can earn a hefty welcome bonus that is comparable to the best business rewards cards on the market.

Cons

- If you don’t need to travel frequently for your business, or your business doesn’t utilize American Airlines specifically for flights, then you may not find this card to be a good fit.

- Many of the card’s extra perks, such as the welcome bonus and annual companion certificate, require quite a bit of spending.

Frequently asked questions

-

No, there are no fees to join the AAdvantage Dining program. Membership is free, and once you register your card, you can start earning miles immediately without any hidden costs or charges.

-

Members can earn up to 5 AAdvantage miles per dollar spent at participating restaurants, depending on their membership level. New members typically earn 1 mile per dollar, but after completing a certain number of qualifying visits, you can increase your earning potential.

-

You can find participating restaurants by visiting the AAdvantage Dining website or using the mobile app. The site allows you to search for nearby locations based on your ZIP code or city, making it easy to discover where you can earn miles while dining out.

The bottom line

If you are undecided about joining the American AAdvantage Dining program, try not to overthink it. The program is totally free to join and it’s possible plenty of the restaurants you already frequently dine at are participating. Why not earn airline miles when you’re spending money at restaurants anyway?

With that said, it may also be worth considering dining programs offered by other airlines like Southwest, Delta and United. You may find different programs that let you earn miles at different restaurants you enjoy, but you’ll never know unless you explore your options.

*The information about the Citi® / AAdvantage® Platinum Select® World Elite Mastercard®, AAdvantage® Aviator® Red World Elite Mastercard® and CitiBusiness® / AAdvantage® Platinum Select® Mastercard® has been collected independently by Bankrate.com. The card details have not been reviewed or approved by the card issuer.

Read the full article here